Campus overview

SAE Institute Nashville was the second SAE Institute campus opened in the U.S. and has become a central part in Nashville's famous Music Row.

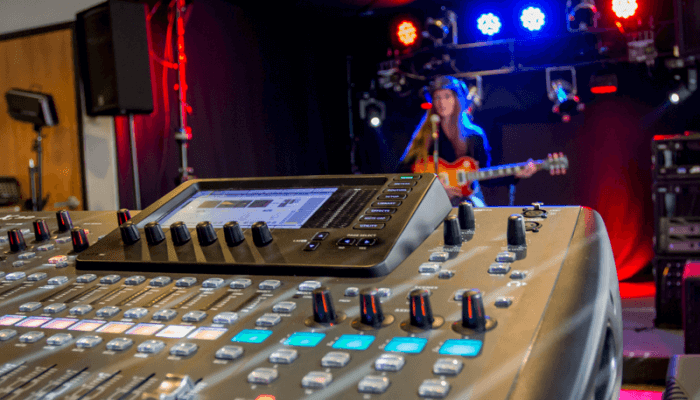

SAE Institute Nashville provides Audio and Entertainment Business education in the epicenter of Music City. From the moment you step foot on the Nashville campus, you will know SAE Institute is well-equipped to offer you a dynamic education in audio and entertainment business.

SAE Institute Nashville offers

Facilities

TAKE A VIRTUAL TOUR

Meet campus director Shannon Meggert

“I love being a part of SAE Institute Nashville.

I joined SAE Institute in 2020 with over 12 years of experience in Higher Education. Prior to that I spent many years in an (unfulfilling) Account Management career in the Automotive industry. I found my home working in Education. Watching students learn and grow is by far my favorite part of what I do.”